-

Australia’s inflation battle is not over — and households are being told to brace for longer-lasting pressure. In recent parliamentary testimony, the Reserve Bank of Australia (RBA) warned that inflation may remain uncomfortably high until at least 2028, even as interest rates weigh on spending and borrowing decisions. For many households working with an accountant…

-

The RBA has decided to increase the cash rate by 25 basis points, from 3.6% to 3.85%, at today’s meeting. In the following blog, we will share further insights into this decision and explain how the rate increase is likely to impact mortgage holders. Infinity Solution Tax Plus will continue to monitor the RBA’s commentary…

-

The Reserve Bank of Australia (RBA) is scheduled to release its February cash rate decision later today. While the headline interest rate outcome will attract immediate attention, the accompanying statement and overall tone from the RBA are likely to be more informative. Infinity Solution Tax Plus expects a hawkish tone from the central bank regardless…

-

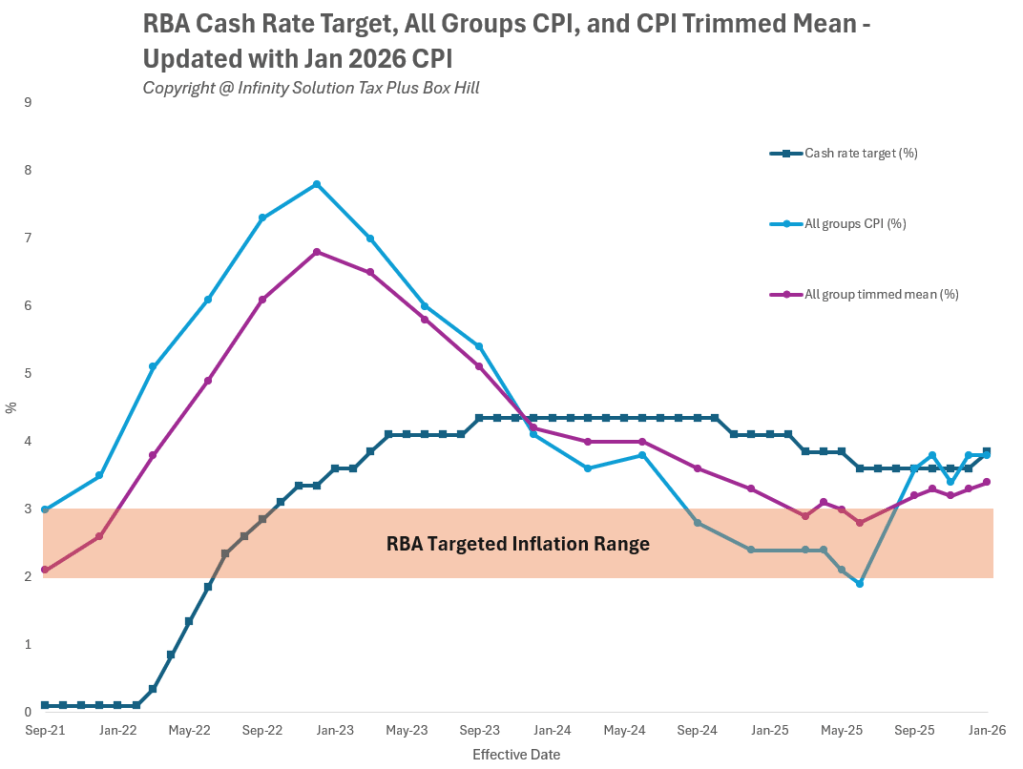

The Australian Bureau of Statistics (ABS) has released the Consumer Price Index (CPI) for December 2025, showing that inflation remains elevated and persistent. For households, businesses, and policymakers, this latest inflation data will be critical in shaping the cash rate in the upcoming RBA meeting. As your trusted accountant Box Hill, we unpack what the…

-

Recent coverage of the December labour force results highlighted strong overall hiring and a fall in the national unemployment rate. Part of that story included more people aged 15–24 moving into employment, contributing to the month’s employment gains. For families, increased teen and student work can help offset rising living costs. At the same time,…

-

News reporting indicates proposed funding reductions affecting the Fair Work Commission over the coming years, alongside warnings about workload pressure and the need for operating changes. An experienced accountant Box Hill brings you the latest analysis.

-

The December labour force data has been released, providing fresh insights into employment trends and economic conditions. This update provides a critical input ahead of the RBA’s upcoming February policy meeting, particularly in relation to cash rate settings. Unemployment Rate – Key Takeaways The latest figures point to a resilient and tightening labour market: What…

-

A recent survey conducted by the American Chamber of Commerce in Shanghai (AmCham Shanghai) reveals a balanced view of business conditions and sentiment in China, offering useful insights for Australian businesses assessing global economic trends. For companies working with an accountant Box Hill, these insights will enable investors to understand how changes in China’s economy…

-

Australia’s rental market remains under pressure, with Domain reporting record-high rents in every capital city except Melbourne. For renters across Sydney, Brisbane, Adelaide, and Perth, competition remains intense as limited supply continues to push asking rents higher. While rental growth has eased slightly in some markets, price levels remain elevated, meaning affordability challenges persist for…

-

Australia’s economy continues to show signs of gradual cooling, with the latest Commonwealth Bank Wage and Labour Insights (December 2025) confirming that wage and employment growth have softened slightly, but remain resilient overall. This trend aligns closely with recent inflation data. As we discussed in our article on the November 2025 CPI showing inflation easing…

- Cash Rate

- Climate Change

- Consumer Price Index

- Economy

- Finance

- General

- Global Economy

- Investment

- Labour Force

- Policy

- Property Development

- Superannuation

- Tax

- Tax Reform

- Tax Return

- Vacant Residential Land Tax

Sienna Jiang is the Founder and Managing Director of Infinity Solution Tax Plus, a Chartered Accounting firm dedicated to helping clients stay financially organised while achieving their business, financial, and personal goals.

A Certified Public Accountant (CPA) with over 10 years of experience in accounting and taxation, Sienna brings broad and in-depth expertise in tax compliance, business advisory, financial reporting, and strategic tax planning for individuals and small businesses — including significant experience working with professionals in the medical field.

She works closely with clients to deliver tailored solutions in tax structuring, business strategy, and long-term planning. Her holistic approach combines practical guidance with personalised support, helping clients simplify compliance, drive growth, and reach their goals with confidence.