-

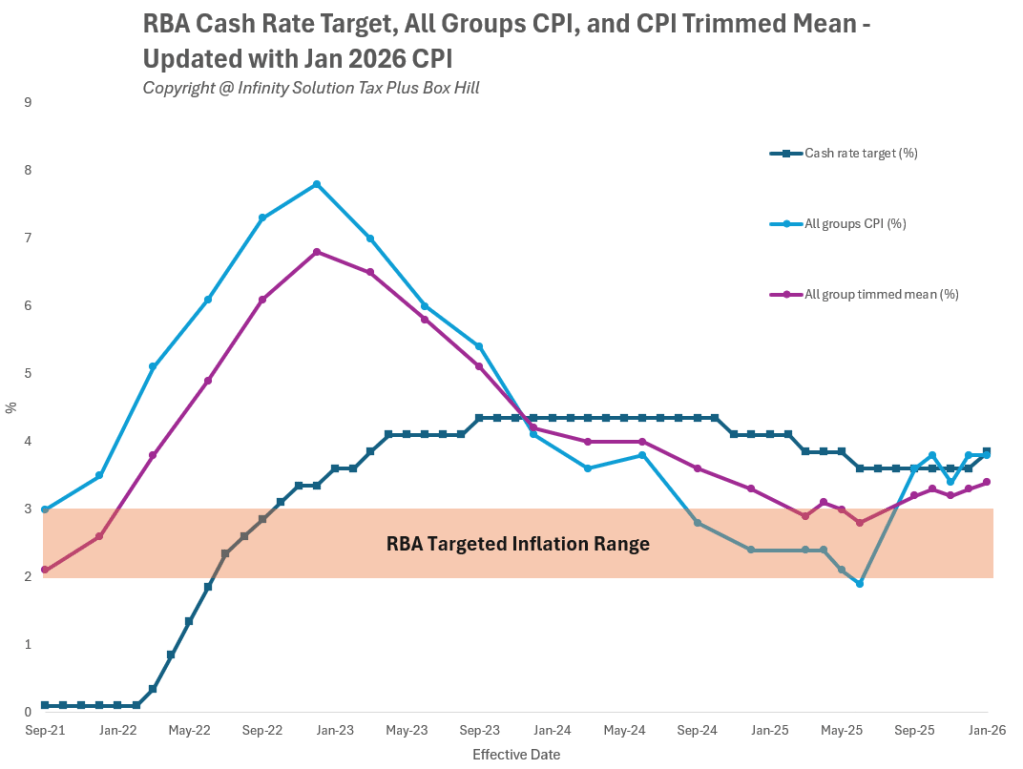

Australia’s first inflation reading for 2026 has been released, with the Australian Bureau of Statistics (ABS) publishing the January Consumer Price Index (CPI) data in late February 2026. The Monthly CPI Indicator provides a timely snapshot of price movements across key household categories, including housing, food, transport, and insurance For households already navigating higher mortgage…

-

Recent commentary from major business leaders has suggested Australia may be approaching a “tipping point”, citing persistent inflation and weak productivity growth as ongoing economic challenges. While headlines can sound dramatic, the underlying economic mechanics are more structural than sudden. When inflation remains elevated, and productivity growth is subdued, wage increases can struggle to translate…

-

With recent rate increases influencing borrowing capacity and buyer confidence, many households are feeling the pressure through higher mortgage repayments. Behind the headlines, the mechanism is straightforward: when the Reserve Bank of Australia (RBA) adjusts the cash rate, lenders commonly adjust mortgage rates. As at 4 February 2026, the cash rate target is 3.85%. For…

-

Sydney’s auction market is showing the early behavioural effects of higher interest rates: a larger share of properties selling before auction, fewer auctions scheduled, and buyers negotiating harder as borrowing costs rise. Recent reporting noted an increase in pre-auction transactions (around 24% in parts of Sydney) alongside a softer auction run-rate compared with the same…

-

Approximately $19 billion in forgotten superannuation is currently sitting unclaimed across Australia, according to fresh reporting this week, with millions of Australians potentially holding lost or inactive accounts without realising it. For many households, that represents thousands of dollars in retirement savings quietly eroded by duplicate fees or simply left untracked. As an experienced accountant…

-

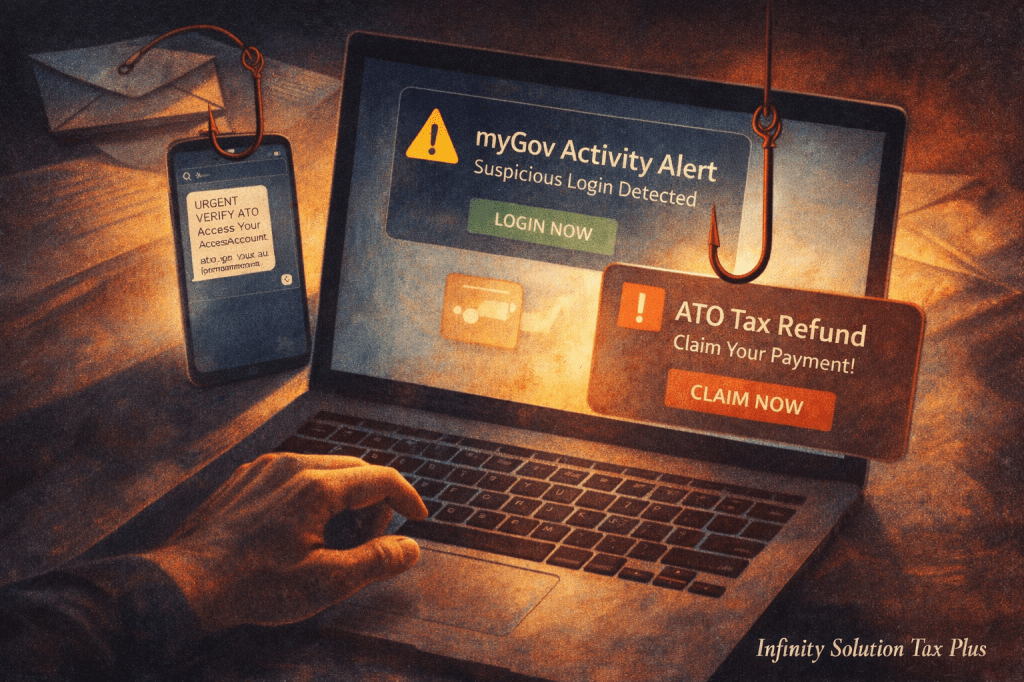

Australians are being warned about ongoing scam activity targeting myGov and ATO-linked accounts, with reporting highlighting increasingly sophisticated phishing emails and SMS messages impersonating government agencies。 The ATO regularly updates scam alerts outlining common tactics, including fake refund notifications, urgent payment demands and links to counterfeit login pages. For individuals managing tax affairs online, supporting…

-

February has delivered a fresh round of professional tax commentary and compliance reminders, highlighting both policy developments and practical obligations for individuals and small businesses [Link 1, 2, 3]. While much of the public debate focuses on large structural reforms, most households are better served by understanding what applies now — and what requires action…

-

Following the recent leadership change, new Liberal Leader Angus Taylor has signalled a firm stance against tax increases. He has downplayed proposed adjustments to the capital gains tax discount, arguing that higher taxes on property could further constrain housing supply at a time when Australia urgently needs more homes. Meanwhile, with inflation and the cash…

-

As part of the CGT tax reform, recent commentary has reignited debate about inheritance and so-called “death taxes”. Political messaging has added further attention. Australia does not currently have a general inheritance tax. However, tax can arise in specific circumstances. For families seeking clarity from an experienced accountant Box Hill, understanding the distinction is critical.…

-

As tax reform discussions broaden beyond super, for many, an investment bond is considered a good alternative. An increased number of client enquiries have seen in this space recently. Investment bonds are tax-paid investment structures where earnings are taxed internally, often up to 30% before credit. For individuals exploring structures with an experienced accountant Box…

- Cash Rate

- Climate Change

- Consumer Price Index

- Economy

- Finance

- General

- Global Economy

- Investment

- Labour Force

- Policy

- Property Development

- Superannuation

- Tax

- Tax Reform

- Tax Return

- Vacant Residential Land Tax

Sienna Jiang is the Founder and Managing Director of Infinity Solution Tax Plus, a Chartered Accounting firm dedicated to helping clients stay financially organised while achieving their business, financial, and personal goals.

A Certified Public Accountant (CPA) with over 10 years of experience in accounting and taxation, Sienna brings broad and in-depth expertise in tax compliance, business advisory, financial reporting, and strategic tax planning for individuals and small businesses — including significant experience working with professionals in the medical field.

She works closely with clients to deliver tailored solutions in tax structuring, business strategy, and long-term planning. Her holistic approach combines practical guidance with personalised support, helping clients simplify compliance, drive growth, and reach their goals with confidence.