In January 2026, news that the US Department of Justice had opened an investigation into Federal Reserve Chair Jerome Powell sent shockwaves through global financial markets. While the issue centres on alleged misstatements to Congress regarding a renovation project, the broader concern is far more significant: political pressure on central bank independence, a foundation of modern economic stability.

What is the Investigation About?

The investigation focuses on whether Jerome Powell misled US lawmakers about the cost and scope of renovations at the Federal Reserve’s Washington headquarters. Powell has strongly denied any wrongdoing, stating that the inquiry is politically motivated and is “a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public rather than following the preferences of the president.”

While the technical issue may seem minor, the response from economists, former central bank leaders, and financial markets has been anything but. Former Federal Reserve chairs have warned that this move risks undermining the independence of the central bank, a principle designed to keep monetary policy free from political influence.

Why Central Bank Independence is Crucial

Central banks like the Federal Reserve are responsible for setting interest rates, managing inflation, and maintaining employment stability. These decisions often involve short-term economic pain for long-term stability, something that can conflict with political goals.

If governments are seen to influence or intimidate central banks:

- Investor confidence may weaken

- Currency volatility can increase

- Inflation expectations may rise

- Long-term borrowing costs can become unstable

This uncertainty is why markets reacted quickly, with gold prices rising and the US dollar weakening following news of the investigation.

Global Implications for Businesses and Investors

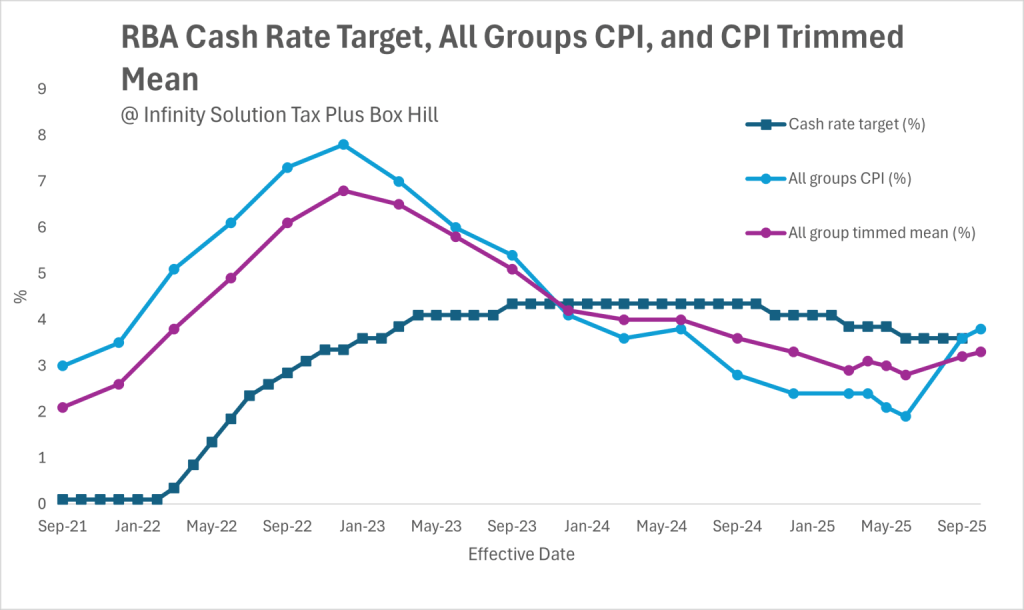

Although the investigation is US-based, its impact is global. Financial systems are interconnected, and instability in US monetary policy can influence exchange rates, inflation, and investment flows worldwide, including in Australia, the very domestic market that Infinity Solution Tax Plus has been monitoring closely.

Navigating Uncharted Waters with Confidence

The Federal Reserve investigation is a timely reminder of how quickly political uncertainty can ripple through the global economy. While these events are beyond individual control, businesses and investors can control how well prepared they are to respond.

In times of economic uncertainty, having the right accounting and tax support makes all the difference. If you need guidance on business accounting, tax planning, tax returns, or advisory services, contact us on (03) 7046 2254 – your experienced local accountant in Box Hill, to discuss how we can support your business during changing market conditions.

Disclaimer: The information contained in this article is general in nature and does not constitute financial or taxation advice. You should seek advice tailored to your specific circumstances from a registered tax or financial adviser.