Financial abuse is gaining overdue attention in Australia, with recent calls for stronger penalties against perpetrators of coercive financial fraud. As highlighted in a recent ABC News report, victims are often left with serious tax, debt, and legal consequences for actions they never consented to.

This growing issue reinforces why working with a trusted accountant Box Hill is critical for financial protection and compliance.

What is Financial Abuse?

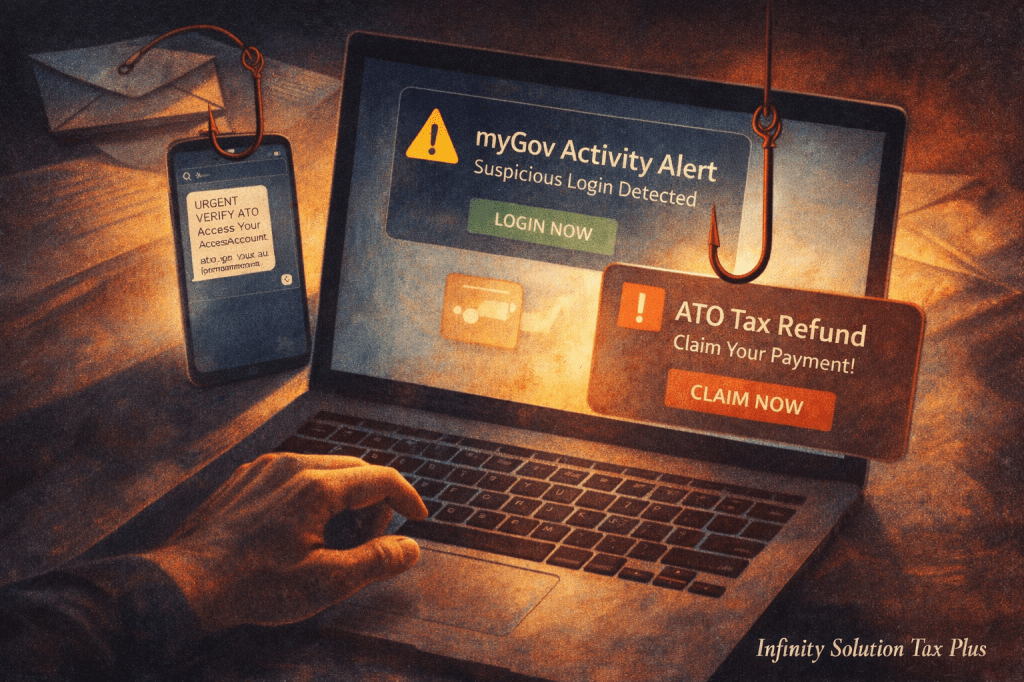

Financial abuse occurs when someone manipulates or controls another person’s finances without consent. According to the ABC report, common examples include:

- Registering a partner as a company director without permission

- Using someone else’s identity to lodge tax returns or take out loans

- Leaving victims liable for ATO debts, superannuation, or business penalties

These actions often go undetected until years later, when authorities pursue the victim, not the perpetrator.

Proposed Legal Reforms and Penalties

The federal government is now consulting on reforms to address these gaps, including:

- Stricter identity and consent checks for company directorships

- Easier processes to remove victims from fraudulent business roles

- Stronger penalties for perpetrators of financial abuse and fraud

For anyone operating a business or managing joint finances, an experienced Box Hill accountant can help ensure proper documentation, compliance, and early detection of red flags.

Why This is Especially Relevant for Tax

Many victims only discover the abuse after receiving ATO notices or director penalty warnings. Without professional guidance, resolving these issues can be overwhelming and costly. A local accountant can:

- Review the company and tax records for irregularities

- Assist with ATO disclosures and dispute processes

- Help protect assets and future financial stability

Protect Yourself with the Right Advice

Financial abuse can have long-lasting consequences, but awareness and professional support make a real difference. If you’re concerned about financial control, unexpected tax issues, or business compliance, speaking with Infinity Solution Tax Plus can help you take control and safeguard your financial future.

Contact us on (03) 7046 2254 today to discuss your business case.

Disclaimer: The information contained in this article is general in nature and does not constitute financial or taxation advice. You should seek advice tailored to your specific circumstances from a registered tax or financial adviser.