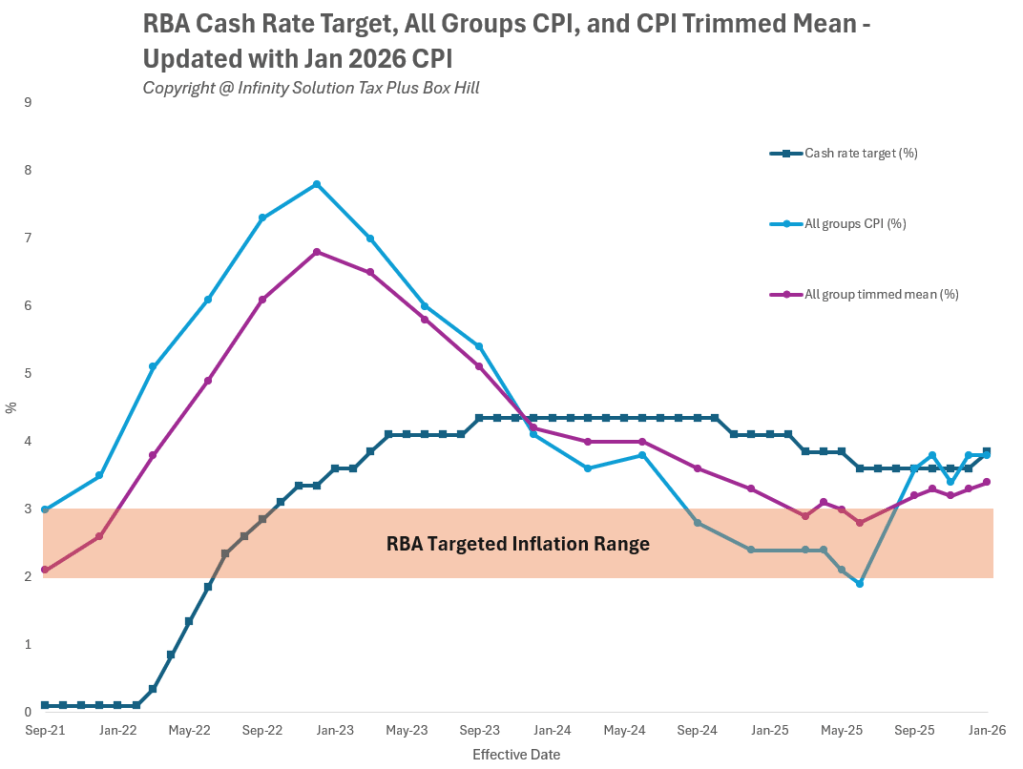

Australia’s November 2025 Consumer Price Index (CPI) data, released today, provides encouraging signs that inflation is beginning to cool, reducing pressure on the Reserve Bank of Australia (RBA) to further increase interest rates.

Headline inflation declined from 3.8% in October to 3.4% in November, while the trimmed mean inflation – the RBA’s preferred underlying measure – also eased from 3.3% to 3.2%. This moderation suggests inflation is moving in the right direction, even though cost pressures remain elevated.

For individuals, investors, and business owners, understanding these trends is essential – and a trusted accountant Box Hill can help translate economic data into smarter financial decisions.

Housing, Food, and Transport Remain the Key Inflation Drivers

Despite the overall slowdown, housing, food, and transport costs continue to contribute the most to CPI growth, reinforcing why cost-of-living pressures are still being felt across Australia.

Housing Costs: still High, but Easing

- Annual increase: 5.2%

- Down from 5.9% in October

- Lower than September’s 5.7%

The easing in housing inflation is a positive sign, particularly for mortgage holders. While rents, interest costs, and utilities remain elevated, the downward trend suggests peak housing inflation may now be behind us.

Food Prices: Steady but Persistent

- Food and non-alcoholic beverages: 3.3% annual increase

Food inflation has remained relatively steady, continuing to place pressure on household budgets. As a non-discretionary expense, even modest increases in grocery prices have a noticeable impact on weekly spending.

Transport Costs: Moderating

- Transport: 2.7% annual increase

Transport cost – including fuel, vehicle maintenance, and travel expenses – has risen more moderately compared to housing and food. The slower pace of increase suggests some easing in fuel-related pressures, offering partial relief for commuters and businesses reliant on transport.

What This Means for Interest Rates

While inflation remains above the RBA’s target range of 2%-3%, the November CPI confirms it is gradually trending downward.

This is welcome news for:

- Mortgage holders, concerned about further rate hikes

- Business owners, managing borrowing and cash flow

Importantly, the cooling inflation data reduces the likelihood of another cash rate hike at the RBA’s February meeting.

Inflation is Easing, What’s Next?

The November CPI data confirms that inflation is cooling, but pressure persists – especially in housing, food, and transport.

The next monthly CPI indicator for December is scheduled for release on 28 January. This data will provide further insight into whether the disinflation trend is continuing into the new year.

We believe that with early signs showing housing price pressures eased in December, the upcoming CPI release offers greater optimism that inflation may continue to moderate.

Infinity Solution will continue to monitor inflation developments closely and keep clients informed with practical, timely insights.

This transitional phase makes proactive financial planning more important than ever. Reviewing cash flow, debt structures, and tax strategies now can position households and businesses to benefit as economic conditions stabilise.

This is where the guidance of an experienced Box Hill accountant becomes invaluable. If you want tailored advice on managing rising costs, interest rates, or tax planning, contact Infinity Solution – your trusted accountant in Box Hill – today.

Disclaimer: This article contains general information only and does not constitute financial or taxation advice. You should seek personalised advice from a registered tax or financial professional.