Since our last update, both ANZ and Westpac have revised their interest rate forecasts, joining the rest of the Big Four Banks. Together, they’re now signalling a clear message — no rate cuts expected in 2026, with the possibility of a rate hike if inflation remains stubborn.

This outlook underscores the importance of financial preparedness, and partnering with an experienced accountant in Box Hill can help individuals and businesses plan confidently in an evolving rate environment.

| Institution | 2026 Outlook | Expected Timing | 2026 EoY Rate | Reference |

| CBA | Hold with risk of hike | – | >=3.6% | Link |

| NAB | Hold with possibility to hike | Early–mid 2026 | >=3.6% | Link |

| Westpac | Hold | – | 3.60% | Link |

| ANZ | Hold | – | 3.60% | Link |

All four major banks are now forecasting that the Reserve Bank of Australia (RBA) will hold rates steady through most of 2025, before considering an increase in 2026 if inflationary pressures persist.

This consensus marks a cautious shift away from expectations of rate cuts and signals a “higher for longer” environment for Australian borrowers and investors.

Why the RBA Might Act Pre-emptively in 2026

During the last interest rate hike cycle, the Reserve Bank of Australia (RBA) adopted a cautious approach before lifting the cash rate by 25 basis points. However, many critics have since argued that the central bank acted too late, allowing inflation to gain momentum before intervening.

In a February 2025 interview, following a 25-basis-point rate cut, RBA Governor Michele Bullock acknowledged this timing issue, stating:

“…, we were late raising interest rates on the way up; we didn’t respond as quickly as we should have to rising inflation.”

While this admission was initially used to justify the rate cut at the time, the reverse scenario is equally important to consider.

In the current environment, the RBA may adopt a more proactive and decisive stance — choosing to raise rates earlier if inflationary pressures begin to re-emerge.

As Australia’s economy enters a critical phase, such an approach could help contain inflation swiftly and support long-term price stability, even if it means short-term tightening.

Upcoming Data Will Be Key

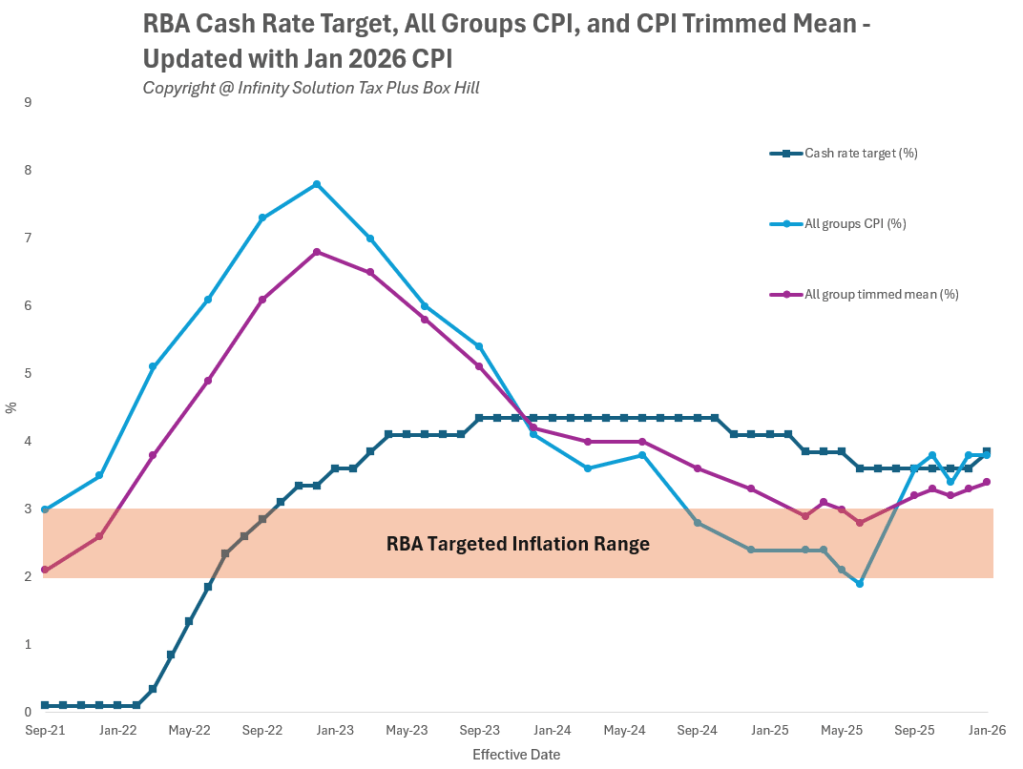

The next RBA meeting is set for 2-3 February, and by then, the Board will have access to two additional full CPI reports (more comprehensive than the monthly CPI indicator). These will offer a clearer picture of inflationary momentum heading into early 2026.

Here’s what to watch:

- If CPI continues to rise through November and December 2025, the probability of a rate hike in February 2026 will increase.

- If inflation begins to ease, the RBA is more likely to hold rates steady while maintaining a hawkish policy stance. However, a series of stronger inflation readings would still be required before the RBA considers any rate cuts.

These insights will shape the central bank’s next moves — and, by extension, the financial decisions of homeowners, investors, and small businesses.

What This Means for Borrowers and Businesses

An extended period of elevated interest rates means:

- Homeowners may continue facing higher mortgage repayments.

- Investors will need to reassess yield strategies amid tighter lending conditions.

- Businesses may face increased borrowing costs, affecting expansion and cash flow.

That’s why now is the ideal time to review your financial strategy. A professional Box Hill accountant can help you model various interest rate scenarios, optimise cash flow, and structure your tax position effectively in preparation for 2026.

Prepare Early with the Right Advice

The message from Australia’s major banks is clear — don’t expect rate cuts in 2026. With the potential for a rate hike on the horizon, it’s crucial to stay informed and proactive.

At Infinity Solution Tax Plus, our team of trusted accountants in Box Hill can help you navigate these economic changes with confidence — from debt management to tax optimisation and business growth strategies.

Stay ahead of the curve. Contact Infinity Solution Tax Plus today to safeguard your financial future.

Disclaimer: This article contains general information only and does not constitute financial or taxation advice. You should seek personalised advice from a registered tax or financial professional.