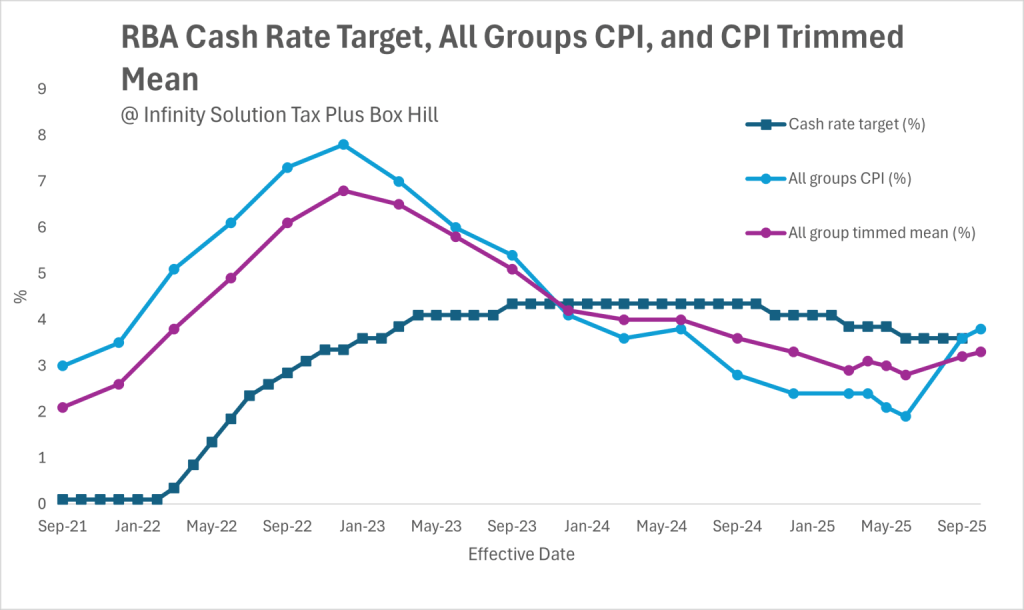

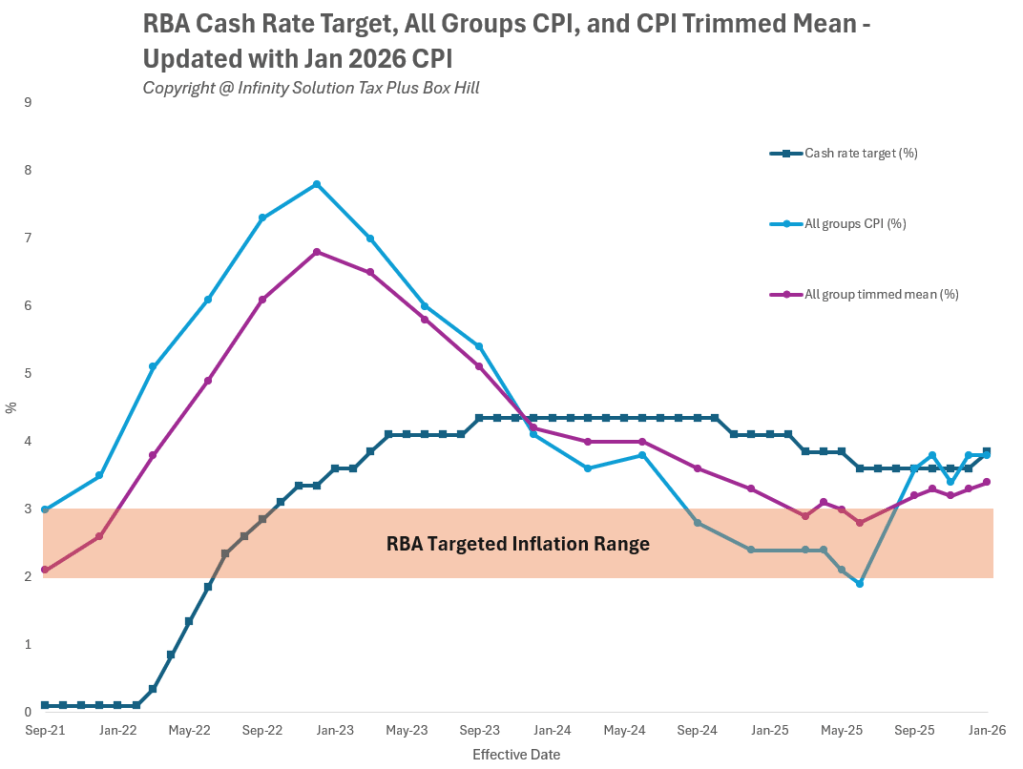

As Australia heads into 2026, the next few weeks will be crucial in shaping the Reserve Bank of Australia’s (RBA) monetary policy direction. With upcoming data releases on inflation (CPI) and employment, analysts and businesses alike are watching closely to see whether conditions may prompt a rate hike in February.

For tailored financial guidance during this critical period, consult a trusted accountant in Box Hill from Infinity Solution Tax Plus to stay informed and financially prepared.

Key Economic Release Dates

The Australian Bureau of Statistics (ABS) will release the final CPI data for 2025 across two key months. These figures are among the most important indicators the RBA considers when deciding on cash rate changes.

| Reference Month | Release Date |

| Consumer Price Index, Australia – November 2025 | 07 January 2026 |

| Consumer Price Index, Australia – December 2025 | 28 January 2026 |

These CPI readings will provide a comprehensive view of inflation trends, especially beyond the monthly indicators. If inflation continues to edge higher, the likelihood of an RBA rate hike in early 2026 increases significantly.

The Labour Force Australia report for December 2025 is scheduled for release on 22 January 2026.

| Reference Month | Release Date |

| Labour Force, Australia – December 2025 | 22 January 2026 |

This report will help assess whether the job market remains resilient or shows early signs of cooling. A robust labour market may reinforce the case for maintaining or tightening policy, while weakening employment data could encourage the RBA to hold rates steady.

The first RBA Board meeting of the year will be held on 2-3 February 2026.

This meeting is expected to set the tone for monetary policy in the first half of 2026. By this date, the RBA will have reviewed both November and December CPI data, along with the December labour report – all critical inputs for determining whether a rate hike is warranted.

Our Expertise

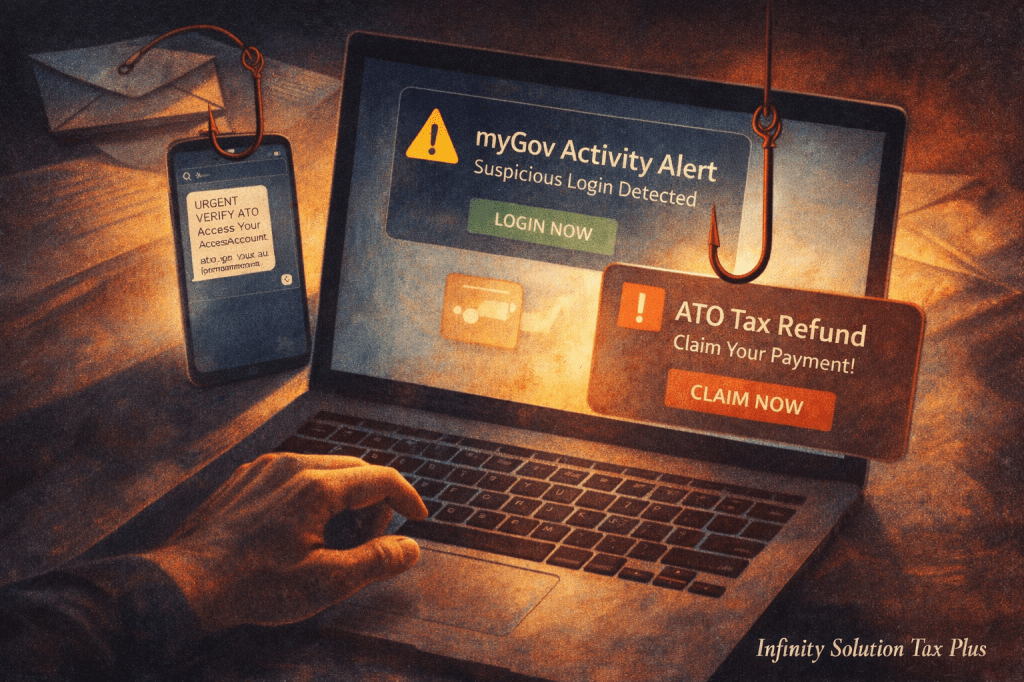

Economic data releases can have wide-reaching effects, from mortgage repayments and business borrowing costs to investment returns. Staying ahead of these developments allows individuals and businesses to make informed financial decisions.

For practical advice tailored to your circumstances, reach out to a professional Box Hill accountant at Infinity Solution Tax Plus. Our team can help you assess risks, plan strategically, and adapt to shifting financial conditions with confidence.

Stay ahead of the curve. Contact Infinity Solution Tax Plus today to safeguard your financial future.

Disclaimer: This article contains general information only and does not constitute financial or taxation advice. You should seek personalised advice from a registered tax or financial professional.