The latest data from the Australian Bureau of Statistics (ABS) shows that Australia’s labour market remains relatively tight, with the seasonally adjusted unemployment rate steady at 4.3%. This update plays a crucial role in shaping expectations for interest rates in 2026, a key consideration for households, business owners, and investors working closely with their trusted accountant Box Hill advisers.

Labour Market Still Tight, but Gradually Cooling

While the unemployment rate has held firm at 4.3%, several indicators suggest the labour market is cooling slowly:

- Employment has softened slightly across recent months.

- The participation rate edged down to 66.7%.

- The employment-to-population ratio sits around 63.8%, reflecting a modest easing.

Though these shifts indicate cooling, the labour market remains stronger than pre-COVID levels. For comparison, in November 2019:

- Unemployment was 5.2%

- Employment-to-population ratio: 62.2%

- Participation rate: 65.6%

This means Australia still has a tight labour market, even with gradual softening since the post-pandemic highs.

For business owners and individuals seeking guidance on how labour trends may affect tax planning, payroll, or cash-flow management, partnering with an experienced accountant Box Hill ensures you’re responding proactively to economic changes.

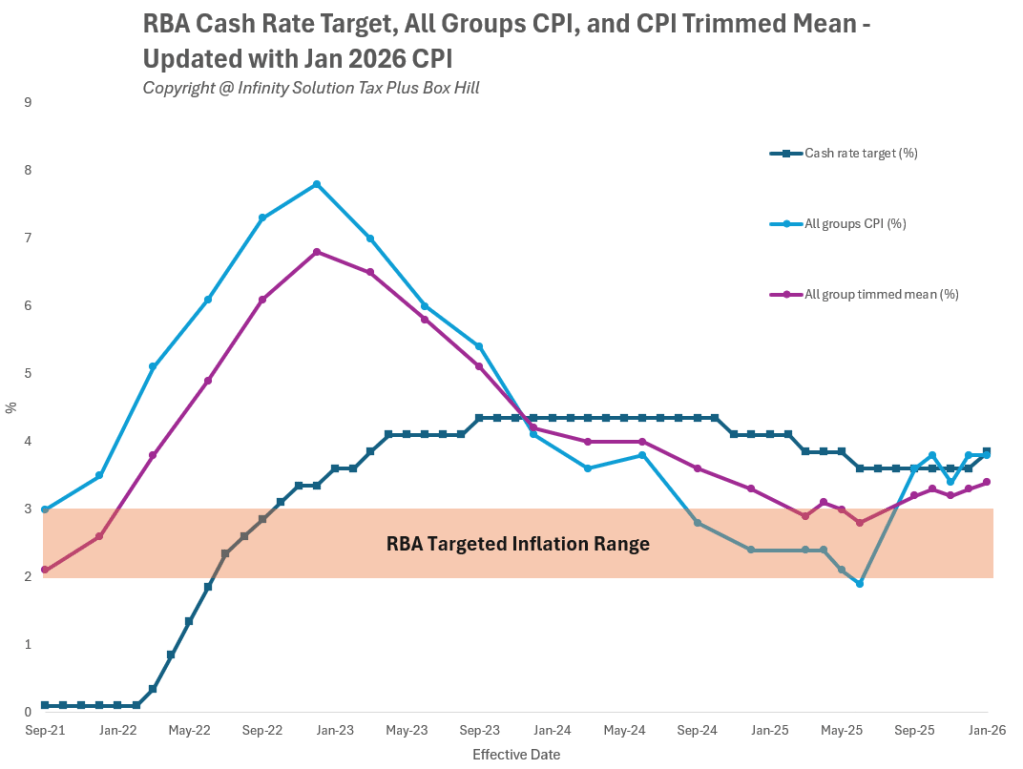

What Does This Mean for the Cash Rate in 2026?

At Infinity Solution Tax Plus, we believe that the labour market data alone is unlikely to shift the RBA’s stance dramatically in the short term.

With the unemployment rate cooling only gradually and inflation still elevated, the RBA is expected to:

- Hold the cash rate at 3.6% for an extended period, likely through much of 2026

- Consider a rate increase only if inflation remains sticky or accelerates

- Re-evaluate its monetary policy if the labour market weakens faster than expected

For small businesses, property investors and families, this means higher-than-expected borrowing costs and the need for strong budgeting and planning.

How a Box Hill Accountant Can Help You Prepare

Economic transitions can create uncertainty, especially when planning for:

- Cash flow

- Staffing decisions

- Investment strategies

- Tax obligations

- Loan refinancing

An experienced accountant in Box Hill can translate economic data, including labour force updates, into practical financial strategies tailored to your situation. This ensures you stay compliant, prepared and financially resilient as the RBA continues to monitor inflation and employment trends.

Key Takeaways

Australia’s labour market is easing, but remains relatively strong. This supports the likelihood of a steady 3.6% cash rate throughout 2026, unless economic conditions change significantly. For businesses and individuals, now is the time to strengthen financial planning, assess risk exposure, and build buffers.

For personalised advice, speak with the team at Infinity Solution Tax Plus — your trusted accountant Box Hill helping small businesses, retail operators, and property investors stay ahead of economic shifts.

Disclaimer: This content is general in nature and does not constitute financial or taxation advice. You should seek personalised advice from a registered tax or financial adviser.