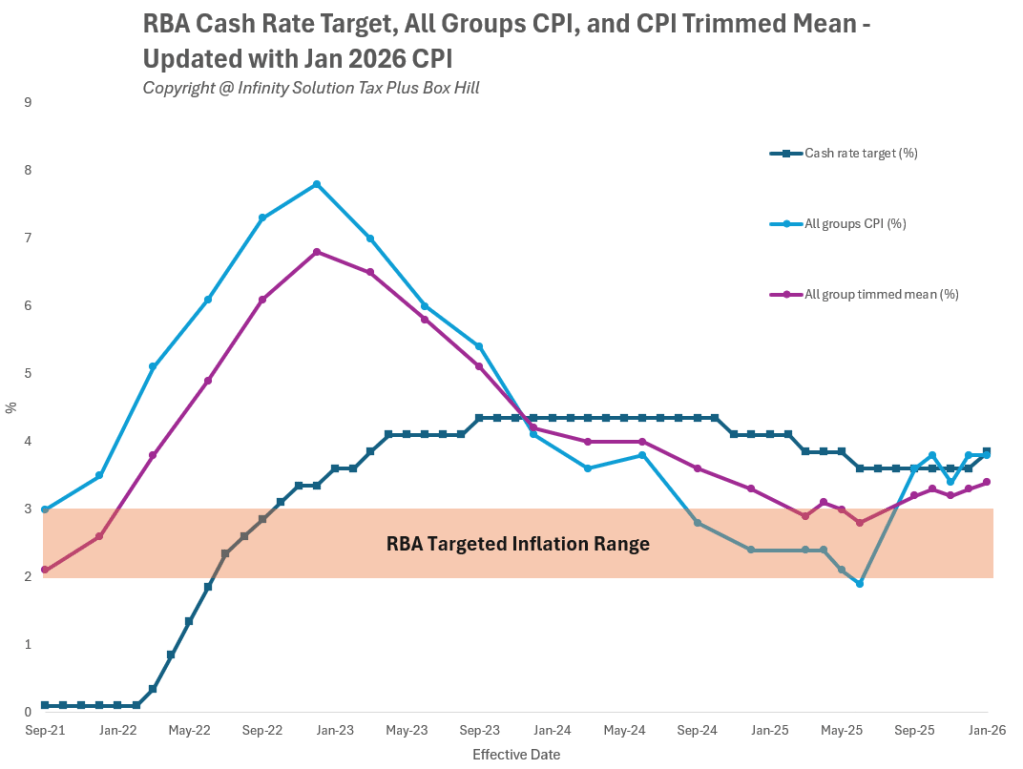

The latest inflation release has again reshaped Australia’s monetary policy outlook, with October headline inflation rising to 3.8% and trimmed-mean inflation hitting 3.3%, both above the RBA’s target range of 2-3%. This unexpected uptick has cooled market expectations for near-term easing and raised new questions about what will happen in 2026.

So, what will RBA decide next? Will investors and mortgage owner face a rate hike in future, as early as 2026?

At Infinity Solution Tax Plus, our specialised team based in Box Hill helps you interpret these critical economic shifts and supports you in making informed, confident financial decisions.

Inflation Surges Again – What Does it Mean for Rates?

The October inflation figures (headline CPI: 3.8%, trimmed-Mean CPI: 3.3%) remain well above RBA’s target range, which is 2-3%. These figures signal that inflation remains sticky and may take longer than expected to return to the RBA’s target zone. With the official cash rate currently at 3.60%, the December interest rate cut that markets once anticipated is effectively off the table.

In its statement released after its October meeting, RBA indicated at:

“… The central forecast in the November Statement on Monetary Policy, which is based on a technical assumption of one more rate cut in 2026, has underlying inflation rising above 3 per cent in coming quarters before settling at 2.6 per cent in 2027. “

This suggests the RBA expects elevated inflation into early 2026, even under a “technical assumption” of one more cut next year. However, given the latest inflation data, that assumption is increasingly fragile.

What Major Banks Now Expect for 2025-2026

We have reviewed forecasts from Australia’s major banks and investment institutions to help our stakeholders interpret the fast-changing rate environment. Here’s an updated summary:

| Institution | Dec 2025 RBA Call | 2025 EoY Rate | 2026 Outlook | Expected Timing | 2026 EoY Rate | Reference |

| CBA | Hold | 3.60% | Previous cut, now hold with risk of hike | – | >=3.6% | Link |

| NAB | Hold | 3.60% | Previous cut, now hold with possibility to hike | Early–mid 2026 | >=3.6% | Link |

| Westpac | Hold | 3.60% | Previous cut, now still cut | As early as Feb, otherwise May and August | 3.10% – 3.35% | Link |

| ANZ | Hold | 3.60% | Previous cut, now still cut | As early as Feb | 3.10% – 3.35% | Link (article released before the November inflation data release) |

| HSBC | Hold | 3.60% | Hold with possible rate hike in early 2027 if not early | Early 2027 | >=3.6% | Link (article released before the November inflation data release) |

| JP Morgan | Hold | 3.6% | Hold or with at most one cut if inflation settles | – | 3.35% — 3.60% | Link |

What does This Mean for Investors and Borrowers?

Most forecasts point towards:

1. No cuts in 2025

The recent CPI surge wiped out any remaining hope of a December 2025 reduction.

2. Zero, or most likely, one cut in 2026

Only Westpac and ANZ still expect cuts – with Westpack expect one and ANZ still two.

3. Real risk of a rate hike in mid-late 2026

If inflation remains above target, a rate hike becomes a genuine possibility – a scenario NAB, HSBC, and JP Morgan all warn about.

4. Labour Market Will Be Critical

A weakening labour market (rising unemployment, slowing wage growth) could push the RBA towards easing rather than tightening.

“Hiking the rate right after an easing cycle is not a decision the RBA will take lightly,” Sienna Jiang, Managing Director at Infinity Solution Tax Plus added “A premature rate hike could suppress consumer spending, reduce retail turnover, worsen the cost-of-living pressures, and hurt the broader economy. It’s one scenario the RBA is very cautious about.”

What You Should Do Now

Whether you’re a business owner, property investor, or household budget planner, this is the time to:

- Stress-test cash flow for higher-rate scenarios

- Review loan structures with your accountant

- Revisit investment strategies for 2026

- Prepare for slower relief on mortgage repayments

- Monitor inflation and unemployment closely

Infinity Solution Tax Plus offers a range of services and our experienced team at Box Hill office can ensure you have personalised strategies tailored to your financial position.

Stay Informed Stay Prepared

While earlier forecasts anticipated multiple rate cuts in 2026, the story has changed. Sticky inflation and cautious central bank commentary now point to:

- A long hold on current rates

- Only one potential cut (if data allows)

- A possible rate hike in late 2026 or 2027

For tailored guidance, speak with the team at Infinity Solution Tax Plus – your trusted Box Hill accountant for small business owners, property investors and retail operators. We’ll continue to monitor updates from the RBA, major banks, and economic think-tanks to help you make confident, informed decisions.

Disclaimer: The information contained in this article is general in nature and does not constitute financial or taxation advice. You should seek advice tailored to your specific circumstances from a registered tax or financial adviser.