The Reserve Bank of Australia (RBA) has decided to hold the official cash rate at 3.6% p.a. during its November 2025 meeting, marking the third consecutive month without a change.

While this outcome disappointed many business owners and mortgage holders, the decision was largely expected, following stronger-than-anticipated inflation figures released in October.

For businesses and investors navigating this environment, understanding the RBA’s rate outlook is crucial — especially when planning cash flow, investments, and tax strategies.

Why Did the RBA Hold the Rate at 3.6%?

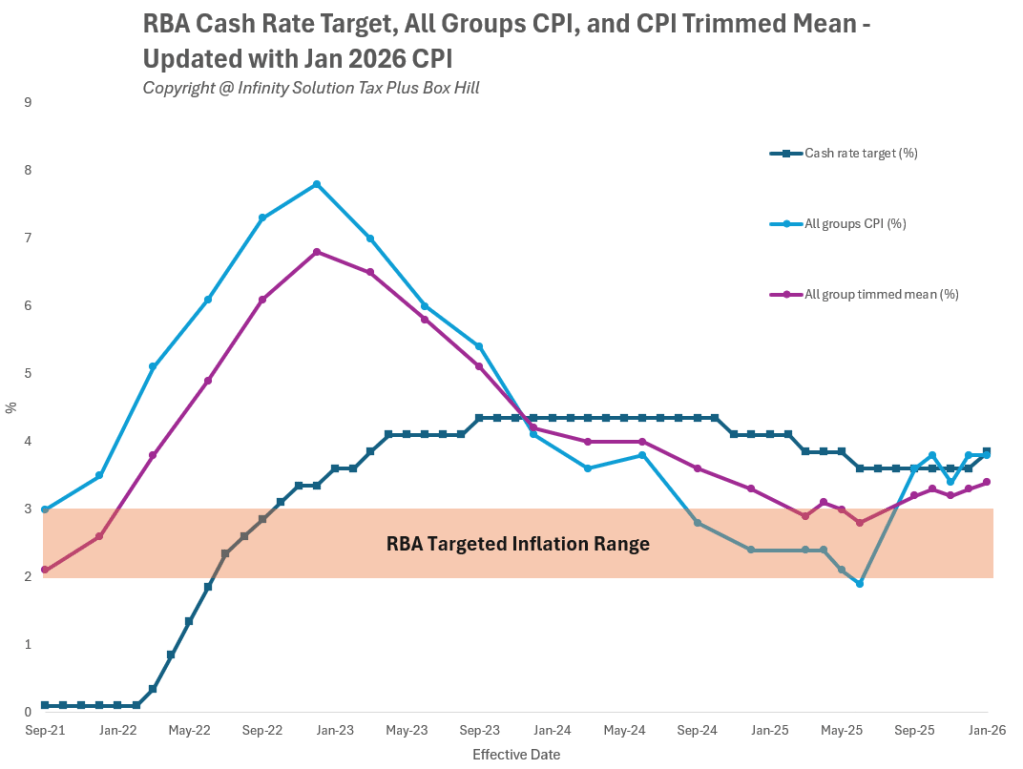

According to RBA’s November statement, the board remains cautious as inflation continues to stay above its target range of 2–3%, despite early signs of moderation.

Sienna Jiang, Managing Director of Infinity Solution Tax Plus, shared her view on this decision.

“Although the absence of a rate cut may disappoint many, it’s important to note that the RBA still anticipates lowering the cash rate in 2027, based on a model that considers inflation to temporarily rise above 3% in Q4 2025 before gradually declining to around 2.6% by 2027.

This outlook suggests that the RBA is prioritising economic stability, expecting inflation to ease naturally over time rather than through further rate hikes — a key takeaway for business owners and investors navigating long-term planning decisions.”

So when RBA will consider its next rate cut?

Predicting the RBA’s next move is never straightforward. However, several key economic indicators can provide valuable insight into when the next rate cut might occur.

Two of the RBA’s most scrutinised focus areas are:

- Labour market strength (employment and wages growth)

- Headline inflation

In a tightened monetary environment, any weakening in the labour market — such as rising unemployment — or a faster-than-expected decline in inflation may give the RBA confidence to begin easing rates sooner.

What Does This Mean for Businesses and Investors?

For small business owners and property investors, the RBA’s decisions have direct implications for borrowing costs, cash flow, and investment returns.

A stable, low cash rate environment may:

- Improve borrowing affordability for business expansion

- Encourage property investment and asset acquisition

- Strengthen consumer confidence and spending

However, with inflation still above target, maintaining financial discipline remains critical. Businesses should continue to manage debt prudently, optimise cash flow, and review tax strategies to stay competitive.

Partner with a Trusted Box Hill Accountant

If you are a business owner, property investor, or planning to start your own business, now is the time to seek professional guidance.

As a trusted Box Hill accounting firm, Infinity Solution Tax Plus offers:

- Tax strategy and compliance services

- Business structuring and planning

- Cash flow and budgeting advice

- Development finance and investment guidance

Contact us today on (03) 7046 2254 or visit us at Level 2B, 818 Whitehorse Rd, Box Hill, VIC 3128.

Partner with an experienced accountant in Box Hill that understands how to navigate changing market conditions with confidence and clarity.

Disclaimer: The information contained in this article is general in nature and does not constitute financial or taxation advice. You should seek advice tailored to your specific circumstances from a registered tax or financial adviser.