When it comes to property investment in Australia, negative gearing is one of the most debated strategies. Whether you are a seasoned investor or just starting your financial journey, partnering with an experienced accountant in Box Hill can help you make informed decisions and navigate complex tax rules with confidence.

What is Negative Gearing?

Negative gearing occurs when the costs of owning an investment property, such as mortgage repayments, maintenance, and management fees, are greater than the rental income earned.

- Example: If your property expenses total $30,000 a year but you only earn $20,000 in rent, you have a $10,000 shortfall.

- Under Australia’s tax system, this shortfall can usually be deducted from your other income (such as salary or wages), reducing your taxable income.

While most commonly associated with housing, negative gearing can also apply to other forms of investment.

Why Negative Gearing?

At first glance, it may seem counterintuitive to invest in a property that costs you more than it earns. However, the strategy offers several benefits:

- Tax advantages: Offsetting losses can reduce your taxable income.

- Long-term focus: Encourages investors to prioritise capital growth over short-term losses.

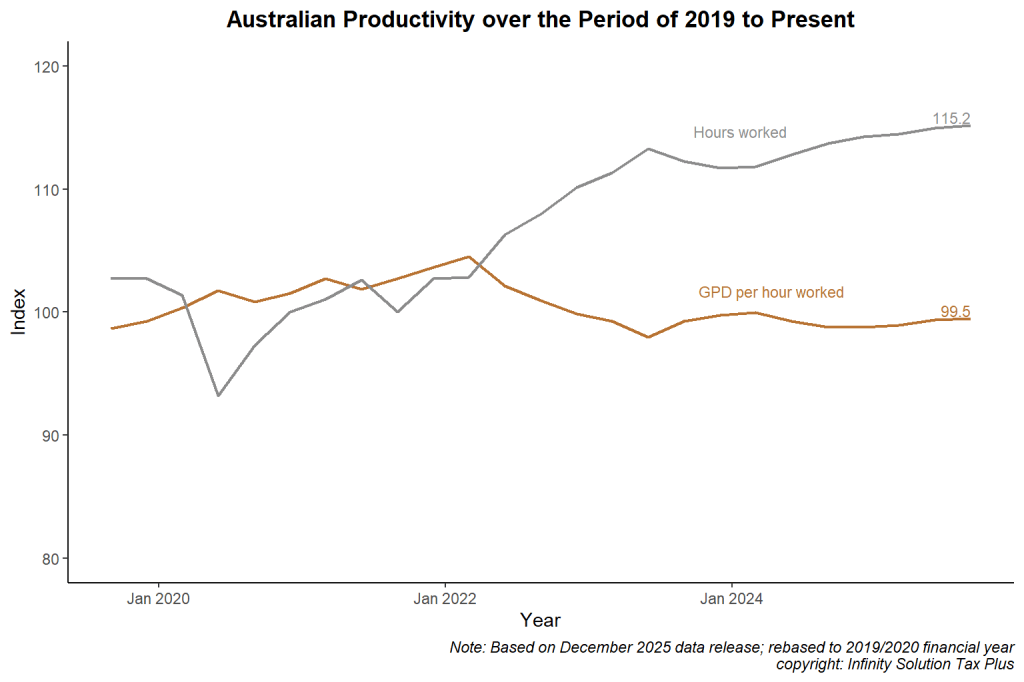

- Market stability: Provides reassurance during volatile periods — for example, during the uncertainty of COVID-19, many investors leaned on negative gearing as part of their strategy.

International Comparison

Australia is not alone in allowing negative gearing. A number of advanced economies have comparable policies, though often with tighter restrictions. For instance, New Zealand, the United States, and the United Kingdom have similar measures in place, but with nuanced differences.

Current Debate

The question of whether negative gearing should be reformed is gaining momentum. Calls for change are strongly supported by organisations, including Australian Council of Trade Unions (ACTU), Unions USW, Everybody’s Home, and the Australian Greens.

Their argument is that reform could ease housing affordability pressures and rebalance the tax system.

On the other hand, critics argue that limiting negative gearing could reduce investment in the rental market and potentially drive up rents in some regions.

Government Position

The Labor government has previously stated that it has no current plans to change negative gearing.

However, following recent Treasury roundtable discussions, Treasurer Jim Chalmers has sought advice from Treasury and engaged with unions, industry groups, and other stakeholders as part of a broader conversation about tax reform.

While no immediate changes are on the horizon, the debate is very much alive, and younger generations, now the largest voting bloc, are pushing harder for reform.

Final Thoughts

Negative gearing continues to shape Australia’s property and tax landscape. Whether reforms occur or not, investors should stay informed and seek professional guidance. At Infinity Solution Tax Plus, we will keep you updated with expert analysis on tax reform and its impact on property investors.

If you need support with your business or personal tax return, speak with Infinity Solution Tax Plus today – your local Box Hill accountant.