We’ve previously explored labour productivity in detail, and today we turn to a broader overview of Australia’s productivity, its position, ongoing challenges, and future opportunities. This is the only agenda item from the Economic Reform Roundtable 2025 that we haven’t yet covered, complementing our earlier discussions on Economic Resilience and Budget Sustainability and Tax Reform.

Productivity in Australia

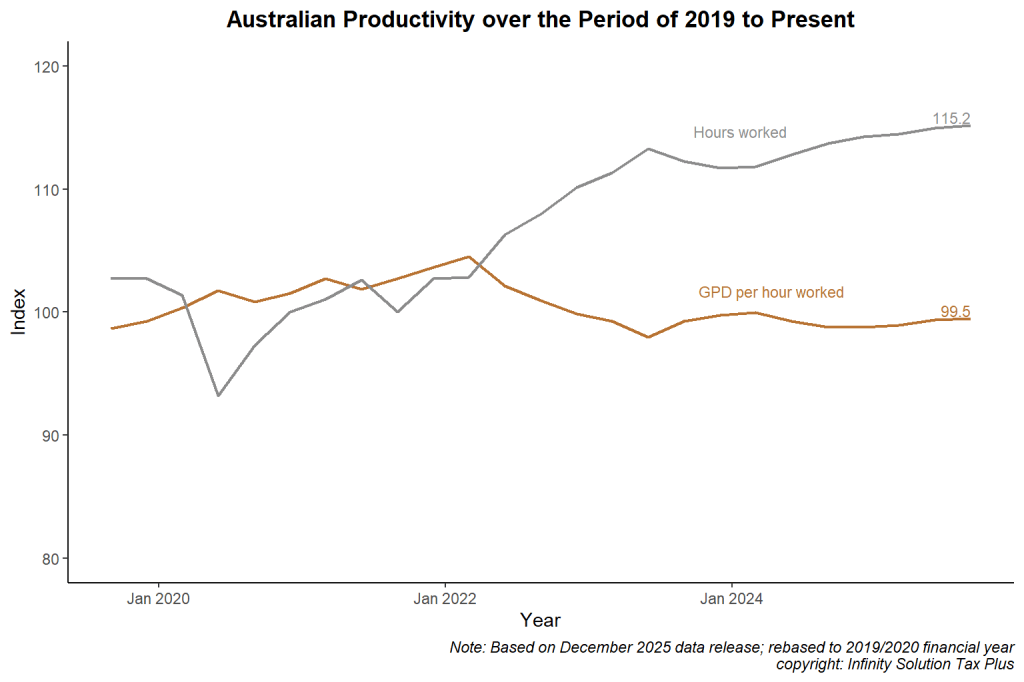

Here are some sobering news:

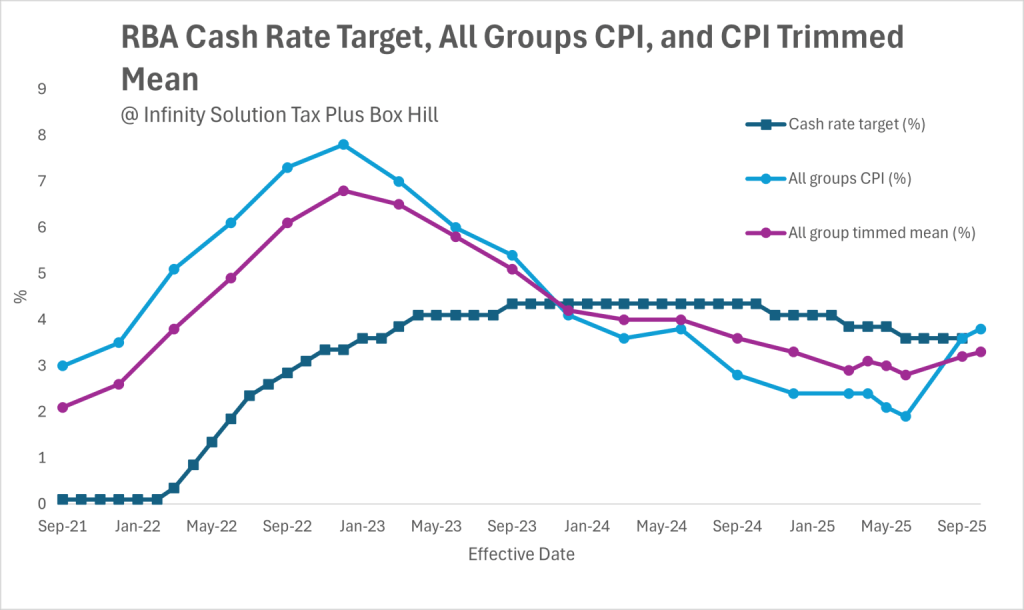

- Lowest in decades: Australia’s productivity growth in the 2010s hit its weakest point in 60 years. Treasury downgraded the labour productivity growth assumption from 1.5 to 1.2 per cent in 2022.

- Global slowdown: other advanced economies, including the US and Canada, have also downgraded productivity forecasts.

- COVID-19 effect: productivity briefly spiked during the pandemic, but quickly fell back to pre-crisis levels, due to the recovery of the labour market lags behind economic output.

Even small declines in growth matter, a fall of 0.3% per year could reduce future incomes by more than $10,000 per person within 40 years.

Challenges

It is crucial for Australians to overcome the following structural challenges to regain and sustain the growth in our productivity.

- Capital deepening: business investment hasn’t kept pace with workforce growth. Despite a rebound, Australia still lags in adopting new technologies compared to countries like the US. International investor is also seeking higher premium when investing in Australia, making it a less preferred investment option.

- Competition and dynamism: fewer new businesses, a lack of competition, rising industry concentration, and more regulation have stifled innovation. Treasury estimates lifting competition could boost GDP by up to 3%, or $6,000 per household in 2024.

- Human capital: one in five Australians have low literacy or numeracy skills, creating barriers to workforce participation. Better education and training are essential.

- Industry shifts: as the economy leans toward services and care sectors, productivity growth naturally slows. However, improvements in measuring service quality (e.g., in healthcare) show there’s hidden value beyond traditional statistics.

Work Underway

The government has already taken steps to improve productivities, including:

- Cutting 500 nuisance tariffs and reforming merger laws.

- Launching a $900 million National Productivity Fund to support competition reforms.

- Investing in digital technology and AI adoption centres.

- Strengthening workforce skills through Free TAFE, a new National Skills Agreement, and migration reforms.

These reforms aim to create a more dynamic, skilled, competitive, sustainable, and future-ready economy.

Final Thoughts

The Roundtable has placed productivity at the centre of Australia’s economic reform agenda because of its direct link to income growth, higher living standards, and long-term national prosperity. With the right mix of targeted reforms and purpose-driven investment, the opportunities for businesses and individuals are significant.

For business owners and professionals, this is a clear call to action:

- Adopt new technologies to stay competitive.

- Upskill and build a future-ready workforce.

- Review your financial and tax strategies regularly to ensure resilience in a changing economy.

At Infinity Solution Tax Plus, our experienced team is closely monitoring these developments. We’ll continue to provide insights and guidance to help you understand what these reforms mean for your financial future.

If you need support with your business or personal tax return, speak with Infinity Solution Tax Plus today – your trusted accountant in Box Hill.