In this blog, we continue our coverage of the recent Economic Reform Roundtable. Previously, we discussed the potential tax reform and its impact on Australians. Now, we shift our focus to Australia’s economic resilience, a vital topic that has been discussed at the Roundtable.

Global disruptions such as COVID-19, supply chain shocks, and climate events have reshaped the way economies operate. For Australians, particularly small businesses, the ability to adapt is the key to long-term success. Understanding current trends, emerging challenges, and government priorities ensures businesses remain competitive, even in turbulent times.

The Uncertain Global Environment

- Global volatility has surged due to COVID-19, regional conflicts, supply chain disruptions, and climate shocks.

- Geopolitical fragmentation is accelerating, with discriminatory trade policies nearly tripling since 2019.

- Structural forces shaping Australia’s economy include global fragmentation, an aging population, industrial shifts, rapid tech adoption, and the transition to renewable.

- Energy transformation is underway, with 90% of coal-fired capacity set to retire within a decade, while renewable already supply nearly half of electricity in Q4 2024.

Evidence of Australia’s Resilience

Despite global headwinds, Australia has demonstrated remarkable resilience:

- Post-COVID growth: while many OECD economies contracted, Australia has consistently expanded, benefiting from its strategic geolocation.

- Labour market strength: over one million jobs created since mid-2022, with unemployment staying low.

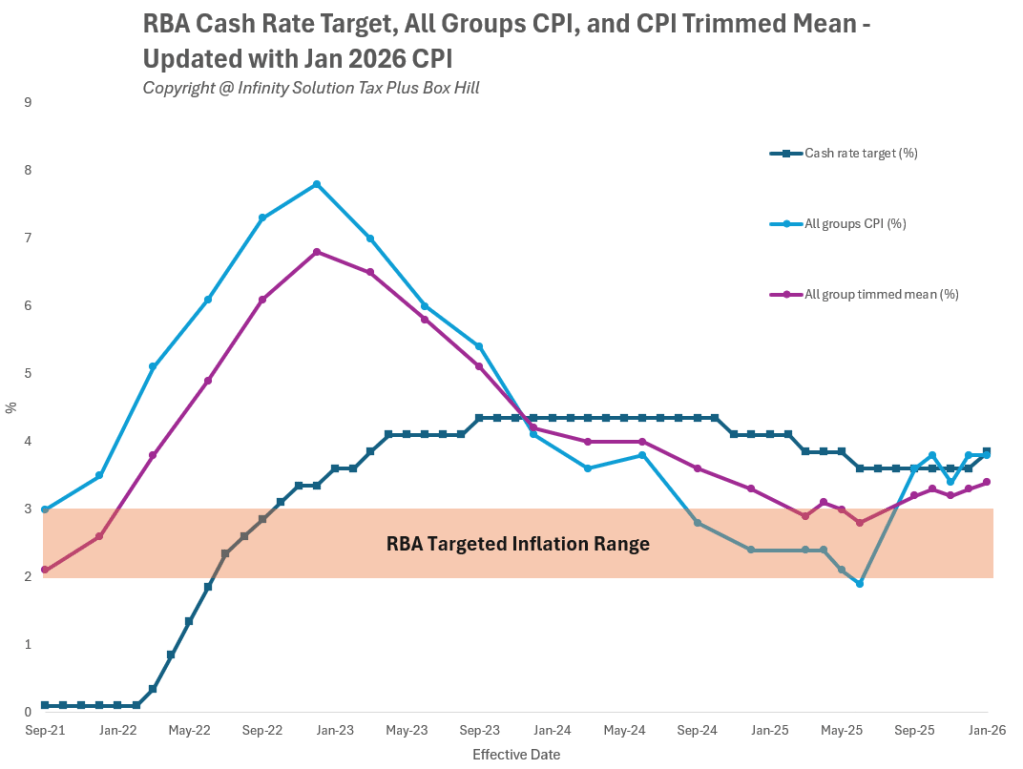

- Price stability: inflation has eased into the RBA target range while growth continues.

- Export performance: exports of goods and services grew faster than GDP between 2019 and 2024.

- Budget discipline: two consecutive surpluses, reduced debt, and the removal approximately 500 nuisance tariffs.

Challenges Ahead

Even with resilience, Australia faces significant long-term challenges:

- Demographics: by 2065, the 65+ population will double, while those over 85 will triple, putting pressure on health and age care systems and government funding.

- Skills gap: high-value production and services demand more advanced training and adaptability.

- Geopolitical risk: One-third of exports depend on China, exposing Australia to regional tensions.

- Technology transition: rapid AI adoption requires governance, infrastructure, and skilled workers.

- Climate and energy: meeting net-zero targets will require private investment on a similar scale as the LNG boom of the 2010s.

Work Underway

The government has taken steps to strengthen resilience.

- Economic management: inflation control, fiscal repair, and simplified tariffs.

- Trade and industry: friendshoring, critical supply chain investments, and the Southeast Asia Economic Strategy.

- Energy transformation: $20bn Rewiring the Nation and $70bn+ renewable investment through the Capacity Investment Scheme.

- Capital investment: investing in supply chain resilience and critical industries.

- Skills development: Free TAFE, Universities Accord, and a reformed Migration Strategy.

- Innovation: AI Adoption Centres, quantum tech, and digital upgrades for industry competitiveness.

Impact on Individuals and Businesses

Opportunities

- Cheaper renewable energy could lower costs for households and SMEs.

- AI and clean technologies may spark new small-business opportunities.

- Skills programs like Free TAFE create pathways into high-growth industries.

Risks:

- SMEs face upfront costs when adopting digital tools and clean energy systems.

- An aging population increases service demands, potentially diverting public funds away from business investment.

- Rising trade barriers may raise input costs for import-dependent firms.

Final Thoughts

Australia has shown remarkable resilience thanks to sound policy, strong fundamentals, and a forward-looking agenda. Yet demographic shifts, energy transition, and geopolitical risks demand sustained adaptation. For small and medium-sized businesses, success lies in embracing clean energy, digital tools, and workforce upskilling while managing transitional challenges.

Australia’s strategic position and geography, trade links, and adaptability place it in a strong position globally. However, structural changes mean individuals and SMEs must remain agile.

Having a trusted tax accountant by your side prepares you in today’s uncharted economic environment. Contact Infinity Solution Tax Plus today to speak with our experienced accountants in Box Hill who can help you navigate uncertainties and secure your financial future with confidence.

Alternatively, contact us on 03 7046 2254, to organise an initial consultation, or to visit us at 818 Whitehorse Rd, Box Hill.