Australia’s fiscal position is currently one of the strongest among advanced economies, although significant structural and geopolitical challenges lie ahead. As highlighted in a prevoius blog, the recently concluded 2025 Economic Reform Roundtable placed strong emphasis onrevitalising Ausatralia’s productivity. The Roundtable brought together policymakers, business leaders, and academics to light a possible future for Australia.

On day three, budget sustainability and tax reform were discussed. For individuals and businesses, understanding the content of these discussions and potential changes will give you a head start on making informed financial decisions.

Drivers

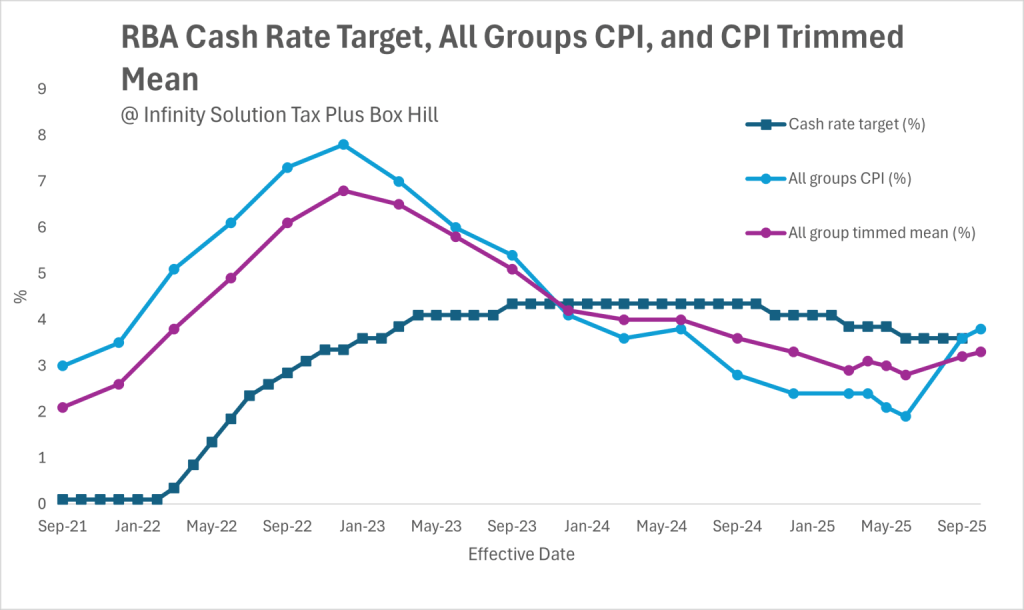

- Strong fiscal position: consecutive surpluses in 2022/23 and 2023/24 financial years, the first in nearly 20 years, give Australia a solid fiscal base, with debt levels lower than most G20 nations.

- Mounting pressures: ageing demographics, the transition to net zero, global instability, and growing demand for health and care services will drive costs higher. Expenditures on programs such as defence, NDIS, Medicare, aged care, interest costs, hospitals, and childcare are projected to grow faster than the GDP.

- Revenue headwinds: fuel and tobacco excise revenues are shrinking, leaving wages to shoulder more of the tax load. Superannuation and capital gains concessions also tilt the balance against younger, working Australians.

Key Priorities

- Intergenerational inequity: reducing reliance on taxing wages while ensuring savings and investments aren’t over-subsidised.

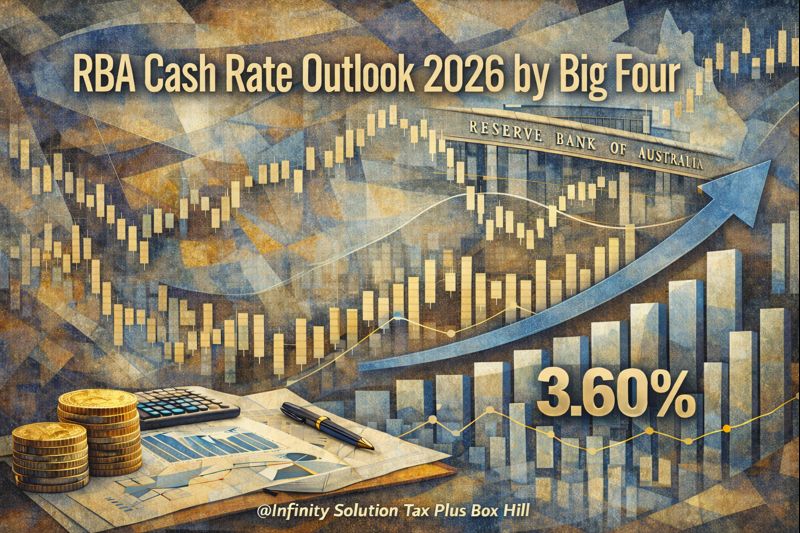

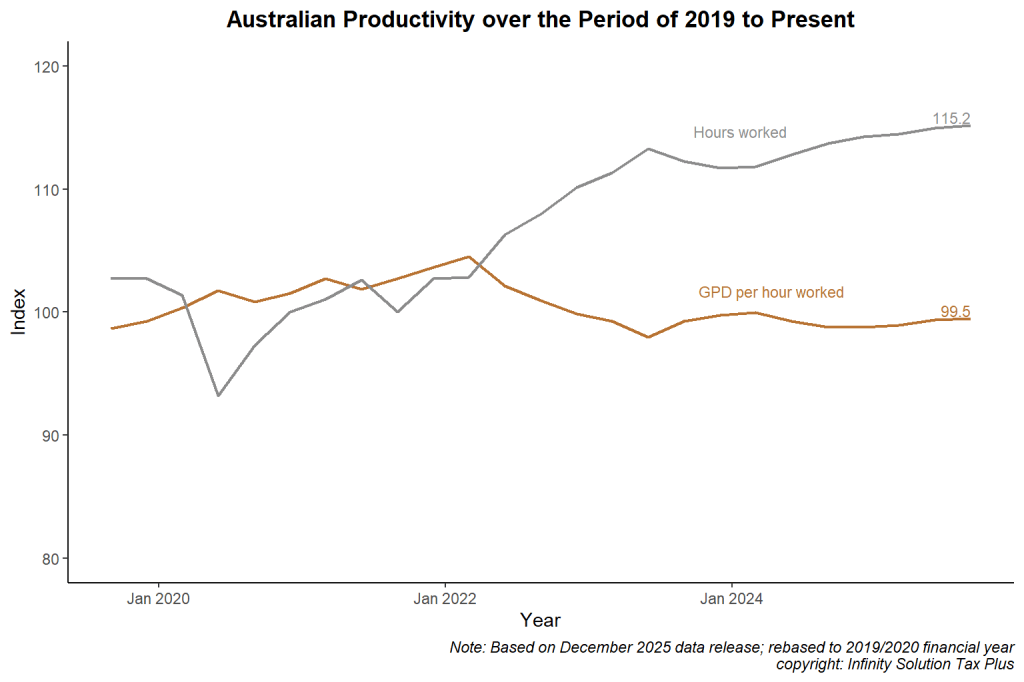

- Boosting productivity and business investment: reforming company tax and supporting a more diversified, renewable-powered economy.

- Simplification and sustainability: making the tax system fairer, easier to navigate, and more reliable for funding essential services.

- Quality of spending: managing growth in big-ticket programs while ensuring service quality.

Work Underway

- Budget repair: a $207 billion improvement in the budget balance since 2022, $100 billion in reprioritised spending, and nearly $250 billion in windfalls banked.

- Structural reforms: NDIS changes to save $60 billion over 10 years, aged care reforms saving $11 billion over 11 years, and debt forecasts lowered by $177 billion compared with 2022.

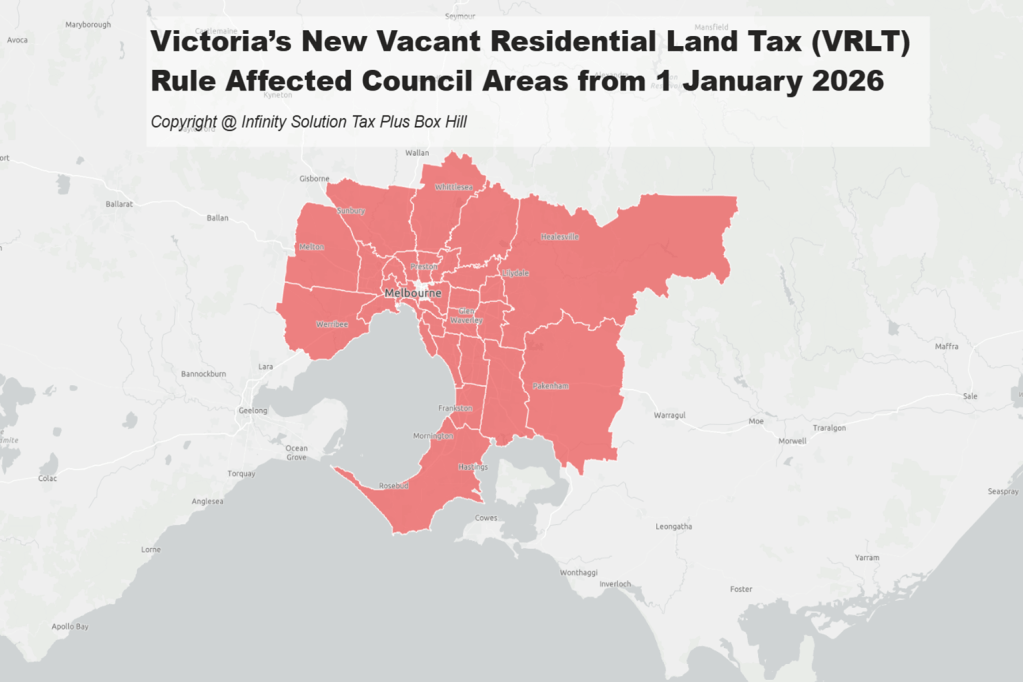

- Tax reform measures: personal tax cuts (2024, 2026, 2027), a $1,000 instant work-expense deduction, PRRT reform, extended $20,000 instant asset write-off for small business, tax breaks for build-to-rent housing, clean-energy incentives, and fairer super concessions.

Final Thoughts

Australia’s budget sustainability challenge is real, but meaningful steps are already taken. The delicate balance between tax relief, fairness, economic growth, and fiscal discipline will shape Australia’s financial landscape for years to come.

Sienna Jiang, founder and managing director of Infinity Solution Tax Plus, emphasises that tax reform is a national priority. While not every individual will see immediate benefits, achieving long-term gains depends on careful planning, thorough analysis, and wise decision-making.

For families, tax reforms can influence take-home pay, superannuation, and investment choices. For business owners, they affect compliance, deductions, and future growth opportunities. Partnering with us, a team of professional accountants in Box Hill, ensures you are well prepared for these shifts and can make informed decisions.

At Infinity Solution Tax Plus Box Hill, we offer a wide range of services, including accounting, bookkeeping, tax planning, business strategy, superannuation, and finance solutions. Our dedicated team will continue to monitor these reforms closely to provide clear, timely advice.

Whether you are managing household finances or running a small business, our team can help you develop the right strategy and plan ahead with confidence, ensuring a strong and healthy long-term financial position.

Contact us on 03 7046 2254, to organise an initial consultation, or to visit us at 818 Whitehorse Rd, Box Hill.